The famous budgeting guru Dave Ramsey once said: “A budget is telling your money where to go instead of wondering where it went.”

Now more than ever, it is essential to tell your money exactly where to go rather than wondering how it all flew out the window without you even knowing. But where should you start? Luckily this handy-dandy Ōdulting guide will help you start a budget that can help you grab your finances by the horns.

Step 1: Set A Goal

The overall goal of your budget is to find and keep as much money as possible, but that newly found money has to have a purpose. If it doesn’t, your precious cash could easily disappear in the next big sale or night out. First things first, figure out what you want the money you save to be for.

This is totally up to you, but some common ones are:

- Safety Net: putting the extra money into a savings account for when something goes wrong, and you need some fallback cash.

- Big Purchase: From a down payment on a house to a new car or even a luxury vacation, you will need big bucks to make these big purchases happen. The money you save could go towards that big purchase you’ve been planning on making.

- Getting Out of Debt: Free yourself from the paycheck-to-paycheck cycle by paying off the things you owe. Use the budget, and the extra money you end up saving, to pay down debts and improve your credit score.

Again, you may have other motivations, or your motivations may fall into one or more of the buckets we mentioned above. Either way, setting up a reason for doing the budget thing will help you stick with it and see your progress as you get closer and closer to your goal.

Step 2: Look At What You’re Spending

To know where to go, you have to check where you have been. Look at your bank statement to see where your money has been going. You may be surprised to learn just how much money you spent each month on going out to eat. You might even cry when you realize how big of a chunk your daycare bill takes out of your budget each month. Breakdown your spending into categories so you can see the bigger picture.

A few common categories are:

- Bills

- Subscriptions (Netflix, Spotify, Gym, etc.)

- Grocery Shopping

- Eating Out

- Gas

- Just for Fun (Movie theater, video games, new clothing, etc.)

- Emergency or Unexpected (car repair, medical bills, etc.)

- Annual Items (vehicle taxes, birthday and holiday gifts, insurance premiums, etc.)

Again, you may have more than these categories listed based on what you purchase each month. Try your best to keep the groups to a minimum so you can see areas you can reduce spending all around. This means don’t nitpick between eating out and happy hour; you still spent money at a restaurant, so you need to know how much of your money is going towards the local restaurant scene.

This step may take you a hot minute, depending on how far you go back. We recommend at least two months, but if you can go back six months, you can get a better idea of your long term spending habits. No matter how far you decide to go back, you can accomplish this step in a few different ways. Old fashioned pen and paper is an option, as well as a spreadsheet (like Google Sheets). You can even use apps that will quickly break down spending by category and then spit out pretty and easily readable graphs.

Be sure, to also look at your income during this step to get an average monthly income. If you get the same amount from week to week, great! Just multiply your weekly paycheck by four, and you’ve got your average monthly income. If you get paid vastly different amounts each week, try to add the weeks together for 3 or 4 months and then divide it by the number of weeks to get your average.

For example:

| Month 1 | Month 2 | Month 3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| week 1 | week 2 | week 3 | week 4 | week 5 | week 6 | week 7 | week 8 | week 9 | week 10 | week 11 | week 12 |

| $250 | $315 | $188 | $250 | $245 | $213 | $196 | $142 | $250 | $200 | $198 | $213 |

| Month 1 Total = $1,003 | Month 2 Total = $796 | Month 3 Total = $861 | |||||||||

| Total Months Combined = $2,660 | |||||||||||

| Average Spending (Total / Number of Wks) = $222 | |||||||||||

| Monthly Budget (Average Spending x 4 Wks) = $887 | |||||||||||

Now you know about how much you will have to work with from month to month and can then move onto the next step, the actual budgeting part.

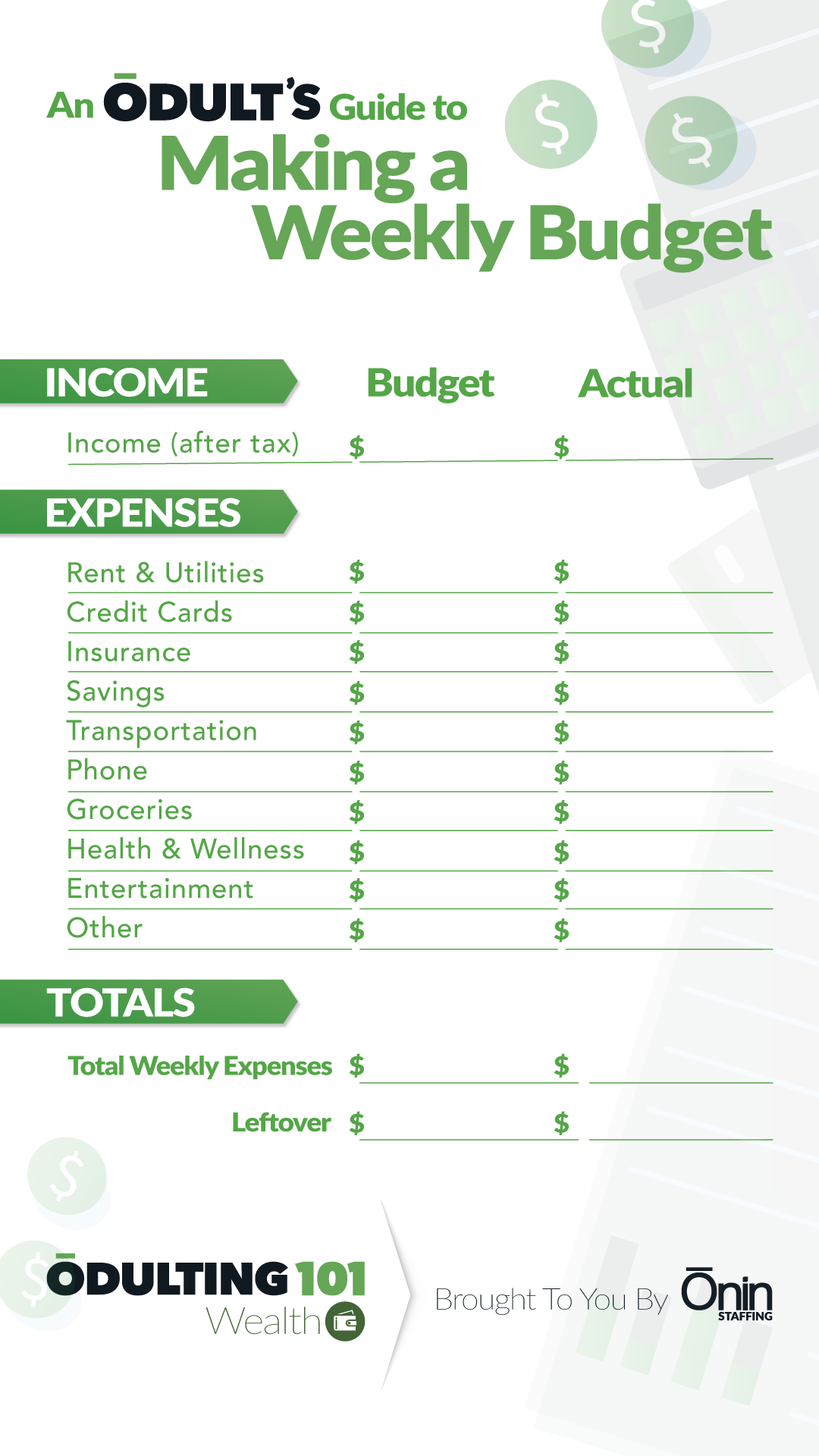

Step 3: Ready, set, BUDGET!

Now, you have figured out:

- What you want to save towards

- The amount of money you usually spend each month

- How much money you make

Next, it’s time to figure out where exactly your money should go. Using the same categories as you did when you were evaluating your spending habits, set up up your budget to show how much you want to spend in each category. Remember, some items are a little out of your control, like bills or emergency items. For bills, you can budget what you usually spend each month, and for emergencies, you can try to budget a little bit of money just in case something happens.

For the things you can control, like eating out, groceries, or subscriptions, be real with yourself on what you actually need and how much you need to shave off that monthly amount. If you are spending $200.00 a month eating out, could you drop that to $100.00 a month and pack your lunch a few days a week instead? For groceries, challenge yourself to spend less by $25.00 or $50.00 a month. See if you can find better sales, coupons or use what’s already at home to save some in that area of your budget. For subscriptions, maybe cancel a streaming service for a month and see if you really miss it. If you can cancel, you now have $10+ in your pocket each month! Get creative with areas you can save in and challenge yourself a little bit at a time.

There are tons of ways to keep yourself honest with your set budget, but a few options are:

- Envelopes: Put cash in envelopes labeled for each category. Once the money runs out in that envelope, no more can be spent in that area for the month.

- Different accounts: While there is a lot of set up on the front end, setting up a new account can help you stay honest with the big-budget items like bills. Set up a bank account separate from your day-to-day spending and only spend certain budget items out of this second account.

- Use an App: There are tons of apps out that can help you see how much you have spent in each category, and when you have gone over or stayed under your budget for the month.

- One thing to remember is that budgets are like diets: if you don’t have a cheat day, you are probably going to fall off the bandwagon at some point. Make sure to budget a little money in the just for fun category so you can treat yourself for working so hard at making the rest of the budget successful.

Bonus Round: Reap the Rewards!

After a few months, you will start to see all the extra dollars you were letting fly away! Progress may be slow at first, but bit-by-bit you will see your emergency fund grow or your debts shrink. It’s a good feeling! You can continue to tweak your budget and challenge yourself to spend less. You may even find ways to eliminate certain categories as you make do with what you have. Now that you have a plan to keep more of your money, go and make it happen!